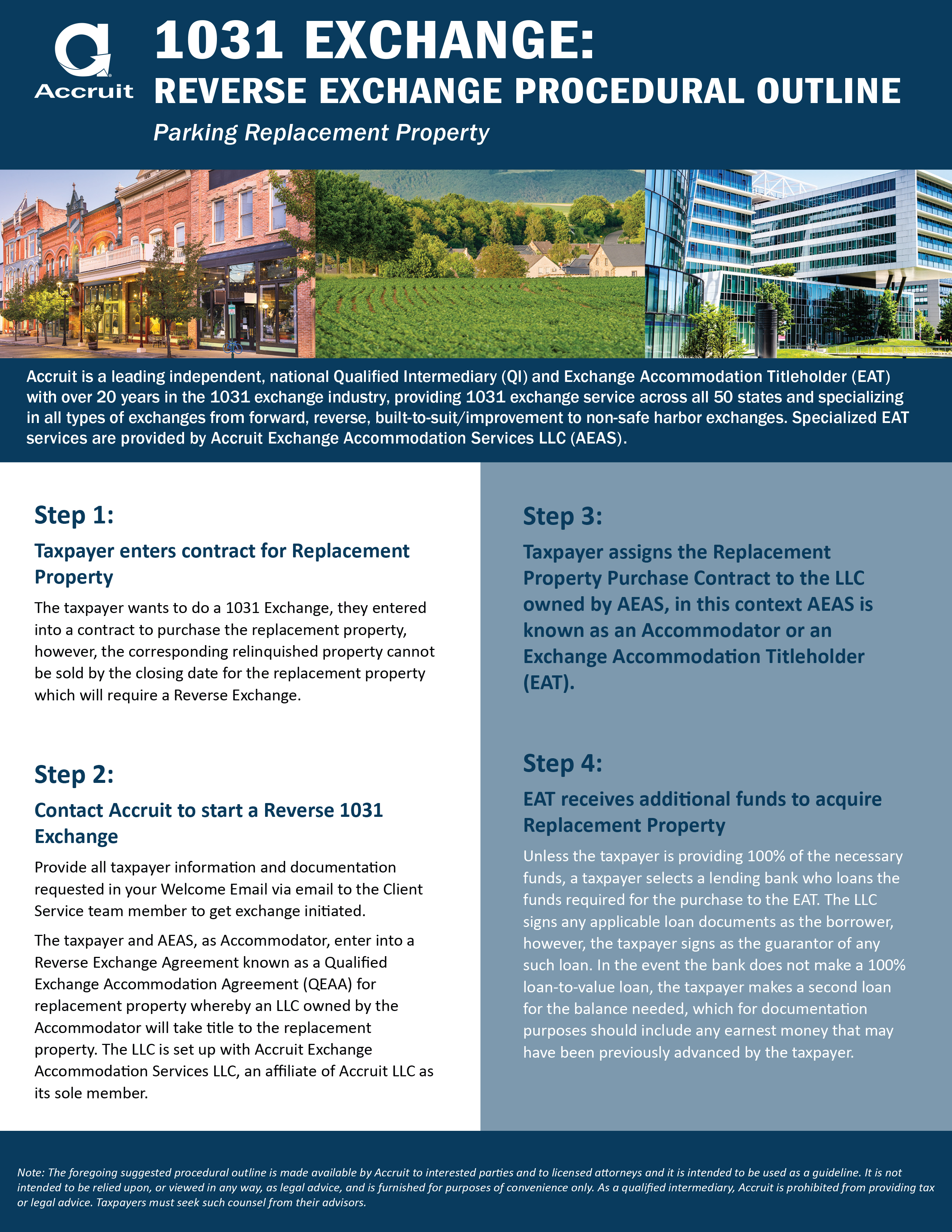

Reverse Exchange Procedural Outline

A reverse exchange occurs when the taxpayer needs to acquire the replacement property before disposing of the relinquished property.

When you're in the position of needing to purchase a new (replacement) property before having sold your old (relinquished) property, a reverse exchange can save you thousands of dollars in capital gains tax. This can be done in one of two ways:

In one, the exchange company purchases the relinquished property (the taxpayer's old property) and holds or "parks" it, pending the sale of that property to a third party buyer.

In the other, the exchange company acquires title to the replacement property on behalf of the taxpayer until the taxpayer sells his old property.

In this whitepaper, we've broken down this second procedure, in which the replacement property is parked, into an explicit and easy to follow series of steps.

When you're in the position of needing to purchase a new (replacement) property before having sold your old (relinquished) property, a reverse exchange can save you thousands of dollars in capital gains tax. This can be done in one of two ways:

In one, the exchange company purchases the relinquished property (the taxpayer's old property) and holds or "parks" it, pending the sale of that property to a third party buyer.

In the other, the exchange company acquires title to the replacement property on behalf of the taxpayer until the taxpayer sells his old property.

In this whitepaper, we've broken down this second procedure, in which the replacement property is parked, into an explicit and easy to follow series of steps.

Download the 1031 PDF by completing the form below.